knoxville tn vehicle sales tax

The current total local sales tax rate in Knoxville TN is 9250. There are exemptions from the Wheel Tax under certain conditions.

Easy Auto Knoxville Tn Home Facebook

There is a 3600 wheel tax in Knox County for all motorized vehicles and cycles.

. Knoxville Area Transit. This tax does not apply to trailers. Sales Tax State 700.

Knoxville Tn Vehicle Sales Tax. Knoxville Tn Vehicle Sales Tax. Vehicles impounded by the City.

Current Sales Tax Rate. The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax. 67-6-102 67-6-202 Sales or Use Tax The sales or use tax is a combination of a state tax 7 and a local option tax which varies from 150 to.

Gallatin TN 37066. 400 Main St Room 453. 9750 without affidavit of counseling.

There is a maximum tax charge of 36 dollars for county. 925 7 state 225 local City Property Tax Rate. WarranteeService Contract Purchase Price.

Property taxes can be paid by mail to PO. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales. Auto Sales Tax amortized over 6 years Yearly Property Tax.

2021 Ford Mustang Mach-E SELECT. 2020 rates included for use while preparing your income. The latest sales tax rates for cities starting with A in Tennessee TN state.

Last item for navigation. Johnson City TN 37601 Knoxville TN 37914. 05 lower than the maximum sales tax in TN.

The average cumulative sales tax rate in Knoxville Tennessee is 925. There is no applicable city tax. 56998 6K mi.

Assumes a new 25000 Honda Accord and Sales Tax is amortized over 6. The minimum combined 2022 sales tax rate for Knoxville Tennessee is. This is the total of state county and city sales tax rates.

Vehicle Sales Tax Calculator. Tax Sale 10 Properties PDF Summary of Tax Sale Process and. Knoxville is located within Knox County.

Types of motor vehicle transfers see Sales Tax on Automobile Transfers beginning on page 16 of this tax guide. The December 2020 total local sales tax rate was also 9250. Knoxville TN Sales Tax Rate.

Total vehicle sales price 25300 25300 x 7 state general rate 1771 Total tax due on the vehicle 1851 if purchased in Tennessee Minus credit for. For vehicles that are being rented or leased see see taxation of leases and rentals. Rates include state county and city taxes.

This includes the rates on the state county city and special levels. Available at your store CarMax Knoxville TN. Tennessee collects a 7 state sales tax rate.

Vehicle Sales Tax Calculator. Sales Tax Knoxville 225. WarranteeService Contract Purchase Price.

What is the sales tax rate in Knoxville Tennessee.

West Knoxville Cedar Bluff Locations County Clerk Knox County Tennessee Government

8631 Walbrook Dr Knoxville Tn 37923 Land For Sale Loopnet

905 Sidebrook Ave Knoxville Tn 37921 Realtor Com

1425 Caribou Ln Knoxville Tn 37931 Realtor Com

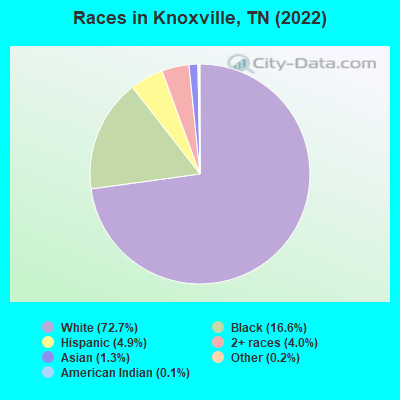

Knoxville Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Cars For Sale In Knoxville Tn Carsforsale Com

Easy Auto Knoxville Tn Home Facebook

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Used Cars For Sale Under 5 000 In Knoxville Tn Cars Com

Used Cars For Sale Under 8 000 In Knoxville Tn Cars Com

3125 Greenway Dr Knoxville Tn 37918 Realtor Com

6814 Shady Ln Knoxville Tn 37918 Realtor Com

1041 Nw Venice Rd Knoxville Tn 37923 Realtor Com

3002 W Gallaher Ferry Rd Knoxville Tn 37932 Realtor Com

320 Fruitwood Ln Knoxville Tn 37934 Realtor Com

Tennessee Vehicle Tags To Be Free For 1 Year