springfield mo sales tax rate 2021

The state sales tax rate for Missouri is 4225. If the state has an outstanding loan for 2 years and is unable to pay back the loan in full by November 10th of the second year the 6 rate will be reduced by only 51 changing the percentage an employer will pay their federal UI tax to 9.

Missouri Sales Tax Guide For Businesses

E-mail us at salesusedormogov or.

. Oversight notes based on the 2021 SalesUse Tax Rate Tables published by the Missouri. If you have suggestions comments or questions about the Sales Tax Rate Information System please e-mail us at salesusedormogov. Gladstone MO Sales Tax Rate.

Local tax rates in Missouri range from 0 to 5875 making the sales tax range in Missouri 4225 to 101. Grandview MO Sales Tax Rate. If an employer pays state taxes timely the 6 rate will be reduced by 54 and the employer will pay their federal UI tax at a rate of 6.

Springfield MO Sales Tax Rate. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781.

Statewide salesuse tax rates for the period beginning April 2021. Sales and Use Tax Rate Tables- For previous rates. The base state sales tax rate in Missouri is 423.

These rates are valid for this location for this quarter for the sales and leases of tangible personal property items and taxable services. The Saint Louis sales tax rate is. Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 9355.

Statewide salesuse tax rates for the period beginning May 2021. However this section could result in a negative fiscal impact in the future should Springfield need to raise the sales tax rate. This page will be updated monthly as new sales tax rates are released.

This is the total of state county and city sales tax rates. This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175. Florissant MO Sales Tax Rate.

Statewide salesuse tax rates for the period beginning October 2021. You can look up your local sales tax rate with TaxJars Sales Tax Calculator. An alternative sales tax rate of 91 applies in the tax region Republic which appertains to zip codes 65802 and 65807.

65801 65803 65804 65805 65806 65808 65809 65810 65814 65817 65890 65897 65898 and 65899. Missouri sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Find your Missouri combined state and local tax rate.

Kansas City MO Sales. The legislation will require out-of-state retailers with at least 100000 in annual sales in Missouri to collect state and local taxes beginning in 2023. The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax and a 213 city sales tax.

The tax continues to be 27 cents for 100 of assessed value. Tax rates are multiplied by your propertys assessed valuation to. The city sales tax rate of 2125 includes a 1-cent General Sales Tax 14-cent sales tax for capital improvements 18-cent Transportation Sales Tax and 34-cent Pension Sales Tax.

Independence MO Sales Tax Rate. Did South Dakota v. Collect sales tax at the tax rate where your business is located.

Next subtract 8584 from 20000 to get 11416. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. The Springfield Missouri sales tax rate of 81 applies to the following fourteen zip codes.

Although capital needs have historically been the focus of the Level Property Tax the 2017 project package included the capability to address ongoing needs as well such as the lifecycle replacement of police cars and fire engines and the staffing for new facilities such as fire stations or infrastructure such. If you have more than one location in Missouri then you would base the sales tax rate you charge on the point of origin of your sale. Youll multiply this number by the Missouri capital gainincome tax rate and add 279.

You pay tax on the sale price of the unit less any trade-in or rebate. In parts of the city there are special taxing districts such. The minimum combined 2022 sales tax rate for Saint Louis Missouri is.

Your current sales tax rate is. Missouri has 1090 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. The County sales tax rate is.

Subtract these values if any from the sale price of the unit and. Springfield collects a 3375 local sales tax the maximum local sales. Joplin MO Sales Tax Rate.

Over the past year there have been 94 local sales tax rate changes in Missouri. What is the sales tax rate in Saint Louis Missouri. The Missouri sales tax rate is currently.

The December 2020 total local sales. Use the Sales and Use Tax Tables and Charts. Statewide salesuse tax rates for the period beginning July 2021.

042021 - 062021 - PDF. Jefferson City MO Sales Tax Rate. 052021 - 062021 - PDF.

Fiscal impact as a result of this section as Springfields sales tax rate is lower than the cap set forth. For other states see our list of nationwide sales tax rate. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax corporation income tax and corporation franchise tax.

Sales and Use Tax Rate Card- For current rates. Assessment Rates Tax Levy Rates. Hazelwood MO Sales Tax Rate.

The Springfield Sales Tax is collected by the merchant on all qualifying sales made within Springfield. The County Clerk is responsible for tracking tax rates for all real estate and personal property in the various political subdivisions ie school districts cities fire protection districts and other special districts within the County. To obtain the sales tax rate information for a general area rather than a specific address you may.

The base sales tax rate is 81. 072021 - 092021 - PDF. Call the Department at 573-751-2836.

This rate means youll pay a base amount of 279 and then 54 percent on whatever is over 8584. 31 rows East Independence MO Sales Tax Rate. The current total local sales tax rate in Springfield MO is 8100.

Taxes Springfield Regional Economic Partnership

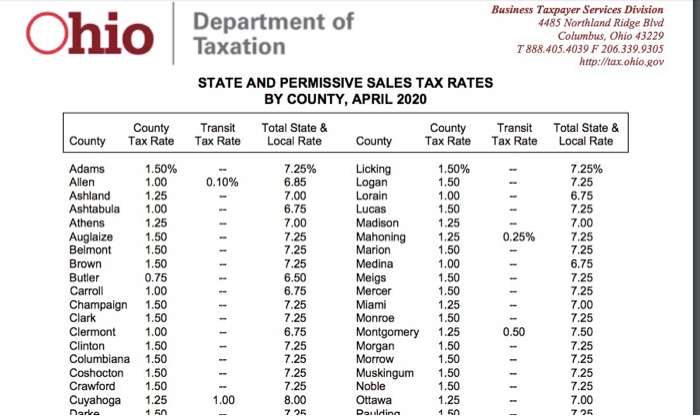

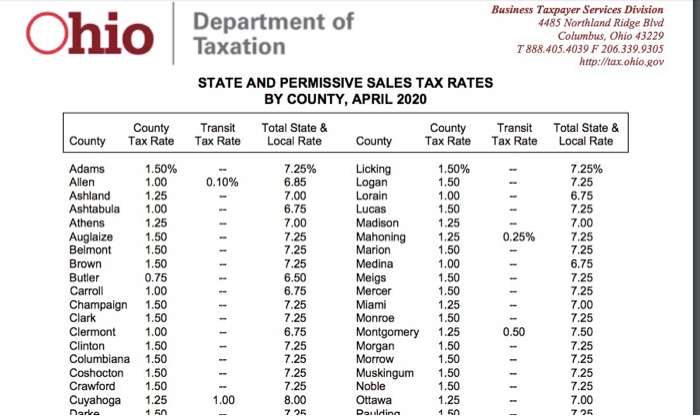

Tam Tersi Vatandas Tilki Ohio Sales Tax Calculator Suitessansbastian Com

Tam Tersi Vatandas Tilki Ohio Sales Tax Calculator Suitessansbastian Com

Missouri Sales Tax Small Business Guide Truic

Missouri Income Tax Rate And Brackets H R Block

Monthly Financial Reports Springfield Mo Official Website

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Tam Tersi Vatandas Tilki Ohio Sales Tax Calculator Suitessansbastian Com

Use Tax Web Page City Of Columbia Missouri

What Is The Sales Tax Rate In Springfield Missouri Slfp

Michigan Sales And Use Tax Audit Guide

States With Highest And Lowest Sales Tax Rates

Missouri Sales Tax Rates By City County 2022

Tam Tersi Vatandas Tilki Ohio Sales Tax Calculator Suitessansbastian Com

What Is The Sales Tax Rate In Springfield Missouri Slfp